Scratching your head about what is in the 2017 Tax Cuts and Jobs Act? You’re not alone—Connecticut was one of the top five states to search “what does tax reform mean for me” in 2018, according to Google Trends. But no matter where you stand on the political spectrum, Cowen Tax Advisory Group is here to make sure you know where you stand with your financial future. Although the changes won’t take effect until Tax Year 2018, here’s what to expect.

1. Less income tax (probably)

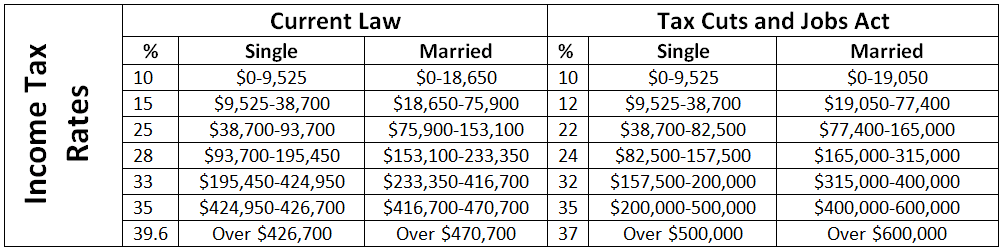

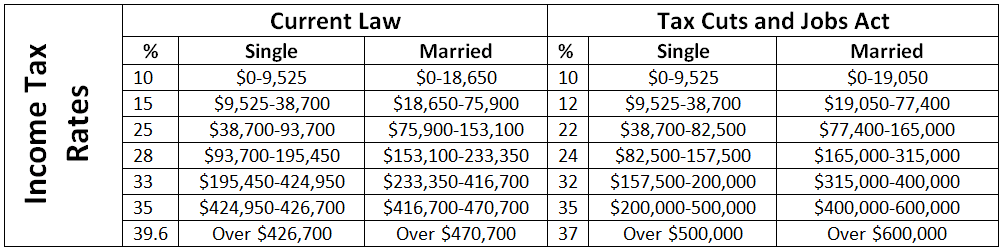

The bill retains seven tax brackets but reduces the rates on six. It also raises the income thresholds at which these rates take effect. For example, a married couple with a joint taxable income of $77,000 will see their income tax fall from 25% in 2017 to 22% in 2018. Use the chart below to determine your new tax rate.

2. An end to personal exemptions

Under the current law, taxpayers can claim a $4,050 personal exemption for themselves as well as their spouse and dependents. The new tax plan eliminates it without substitution.

3. A doubled standard deduction

The standard deduction for single filers will jump from $6,350 to $12,000 in 2018, and from $12,700 to $24,000 for married couples filing jointly. If you currently itemize and use a Schedule A, you may no longer need to, unless your deductions exceed the standard deduction.

4. Caps on state and local tax deductions

If you itemize and take advantage of the SALT break, a deduction for state and local property taxes, and income or sales tax, your deduction will be capped at $10,000.

5. A larger child tax credit

Under the new bill, the current $1,000 credit for children under 17 will double and become available to single filers earning up to $200,000 (currently $75,000) and $400,000 for married couples (currently $110,000).

6. A credit for dependents over 17

Filers supporting ailing parents will have access to a $500 credit per qualifying relative.

7. Miscellaneous deductions no longer available

Deductions for moving expenses, casualty and theft, home office use, travel and mileage, job search expenses, employee parking, and miscellaneous unreimbursed job expenses are now things of the past. However, there are a few exceptions. Moving expense deductions are still available for military service members, teachers can still receive a deduction on up to $250 worth of classroom supplies, and you can still claim a casualty, theft, and disaster deduction if the losses were the result of a federally declared disaster.

8. A smaller deduction for mortgage interest and no deduction for home equity loan interest

Thinking of taking out a mortgage in 2018? Keep an eye on your debt! The new bill lowers the cap on mortgage interest deductions—currently set at $1 million—to $750,000. However, this only applies to mortgages made after January 1, 2018. The old deduction will still be available for mortgages established before the new year. The bill also eliminates the deduction for interest on home equity loans unless the funds were used ti buy, build, or improve the property.

9. Higher exemptions and phaseouts on the Alternative Minimum Tax

If you currently pay the AMT but are a single filer making less than $77,300 or a married couple making less than $109,400, you are now exempt. Curious about the AMT and how it works? Check out this helpful article from The Balance.

10. Deductions for student loan interest, classroom supplies, and medical expenses are here to stay

Although earlier versions of the GOP tax plan eliminated these popular tax breaks, as well as the tax-free status on tuition waivers for graduate students, the final bill leaves them intact. It even grants a two-year expansion for the medical expense deduction.

11. A higher exemption on estate, gift and generation-skipping taxes

Very few of us are fortunate enough to claim estates in the $5 million to $10 million range, but if this happens to be you, break out the champagne; you are now exempt from the estate tax. For more on gift and generation-skipping taxes under the new bill, this Forbes article has you covered.

12. Slower (and lower) inflation adjustments

The GOP tax bill institutes a slower inflation measure to adjust eligibility and maximum value than the one currently used. This means that over time your deductions, exemptions and credits will lose more value, while more of your income will be subject to higher taxes.

13. No more health insurance mandate and higher premiums

Say goodbye to the Obama-era penalty for lacking health insurance and hello to possibly higher premiums as more healthy people choose to go without. However, you might not want to ditch your healthcare just yet: the penalty will still apply in 2018.

14. A 2025 expiration date

All of the above changes for individual filers are set to expire in 2025.

Want to know what the 2017 Tax and Jobs Act means for your business? Click here.

Sara McKinney

saractag@gmail.com

Sara is a recent graduate of Kalamazoo College and a new addition to the Cowen Team. Her responsibilities include IT support, event planning, and general administrative assistance.