On June 13th, the Federal Reserve raised interest rates for the second time this year and, according to Fed Chairman Jerome Powell, we can expect two more rate hikes before 2019. Viewed from a distance, rising interest rates are a sign of economic prosperity. With unemployment hovering around 3.9% and wages slowly but steadily creeping upwards, banks can afford to tack more interest onto savings and debt. On the ground level, however, interest rate growth can chafe where retirees need it least; credit card bills, mortgages, loans, and bonds. Here’s what to expect in the year ahead:

Savers Rejoice

Since the 2008 recession, interest rates have languished at abnormally low levels, resulting in low returns on CD’s, savings accounts, and fixed annuities. But as rates climb toward the Fed’s 2% goal, accounts that rely on interest rates for growth will become more lucrative.

What to do: If you’re shopping around for a new CD or multi-year fixed interest annuity, you may want to hold out until the end of the year in order to take full advantage of the rate hikes. If you have a CD or low-earning annuity nearing maturity, consider transferring or rolling over part of your funds into a new account with higher interest.

Lower Bond Prices

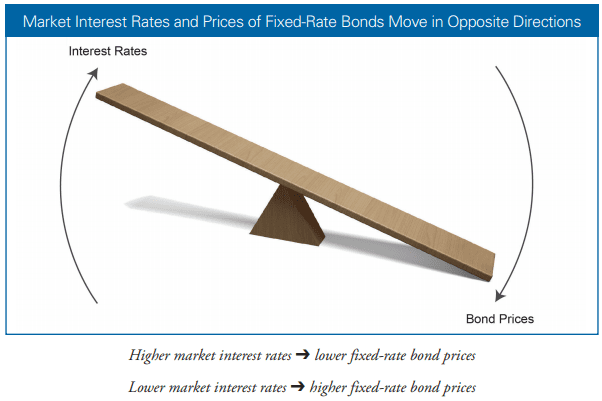

Interest rate risk: chances are you’ve heard of it, although maybe not by name. It’s the see-sawing relationship between bond prices and interest rates which says that when one goes up, the other must come down.

As a result, fixed-rate bonds purchased in a low-interest environment will decrease in market value as interest rates climb. This is especially true of long-term bonds, which take longer to mature than their short-term counterparts and are likely to see greater interest growth. Since bonds tend to be more conservative investments than stocks, the bond market is often touted as a safe haven for investors nearing retirement. The result? Interest rate risk disproportionately affects older investors, who are likely to weight their portfolios toward bonds, at the expense of higher returns.

What to do: Make sure your bond portfolio is properly diversified with a good mix of short- and long-term funds.

The Deal with Debt

Credit cards, mortgages, auto loans—chances are you have one or more, and with interest rates on the rise, debt is about to get more expensive. In fact, the housing market is already starting to register the change, with a notable increase in mortgage applications, primarily applications to refinance home loans.

What to do: Get serious about dealing with your debt. Pay off as much as you can on credit cards and mortgages before the next Fed hike to avoid the extra interest payment. Not sure where to start? We’ve got a few tips to help you hit your financial goals.

Inflation Control

Have you been paying more at the pump these last few months? So have we. It isn’t your imagination: inflation is on the rise. According to the Bureau of Labor Statistics’ consumer price index, the cost of living hit a six-year high in May, and wages are failing to keep pace. Luckily, higher interest rates help control inflation and can stabilize prices as Americans choose to borrow less and save more.

What to do: Adjust your budget to accommodate the higher cost of living while making sure you have enough left over at the end of the month to save something.

Sara McKinney

saractag@gmail.com

Sara is a recent graduate of Kalamazoo College and a new addition to the Cowen Team. Her responsibilities include IT support, event planning, and general administrative assistance.